« Blog sur les casinos en ligne, le trading et autres solutions pour réussir sa vie »

Nos solutions

Casinos en ligne

Au milieu des solutions que nous vous proposons pour réussir votre vie, les casinos en ligne sont sûrement l’une des meilleures opportunités. Au-delà de vous divertir, vous pourriez gagner beaucoup d’argent !

Les casinos en ligne, un moyen de gagner un complément de revenu

Vous vous trouvez souvent dans le rouge après le paiement de vos factures mensuelles ? La suppression de certains postes de dépenses ne constitue généralement pas la meilleure solution. Pourquoi ne pas essayer de gagner du revenu supplémentaire en jouant sur des casinos en ligne ?

Arrondir ses fins de mois grâce au casino

Le savez-vous ? Le recordman du plus gros gain sur un casino en ligne n’a misé seulement que 20 centimes. Cela lui a suffi tout de même pour remporter la somme modique de… 17,8 millions d’euros en janvier 2013. Gagner sa vie grâce aux jeux en ligne est ainsi possible. Cependant, notre engagement pour le jeu responsable vous demande d’en faire une source de revenue complémentaire, non pas principale. Mais quelles plateformes privilégier pour cela ? En voici les deux plus importantes. Si vous préférez les casinos terrestres, voici le casino de l’année.

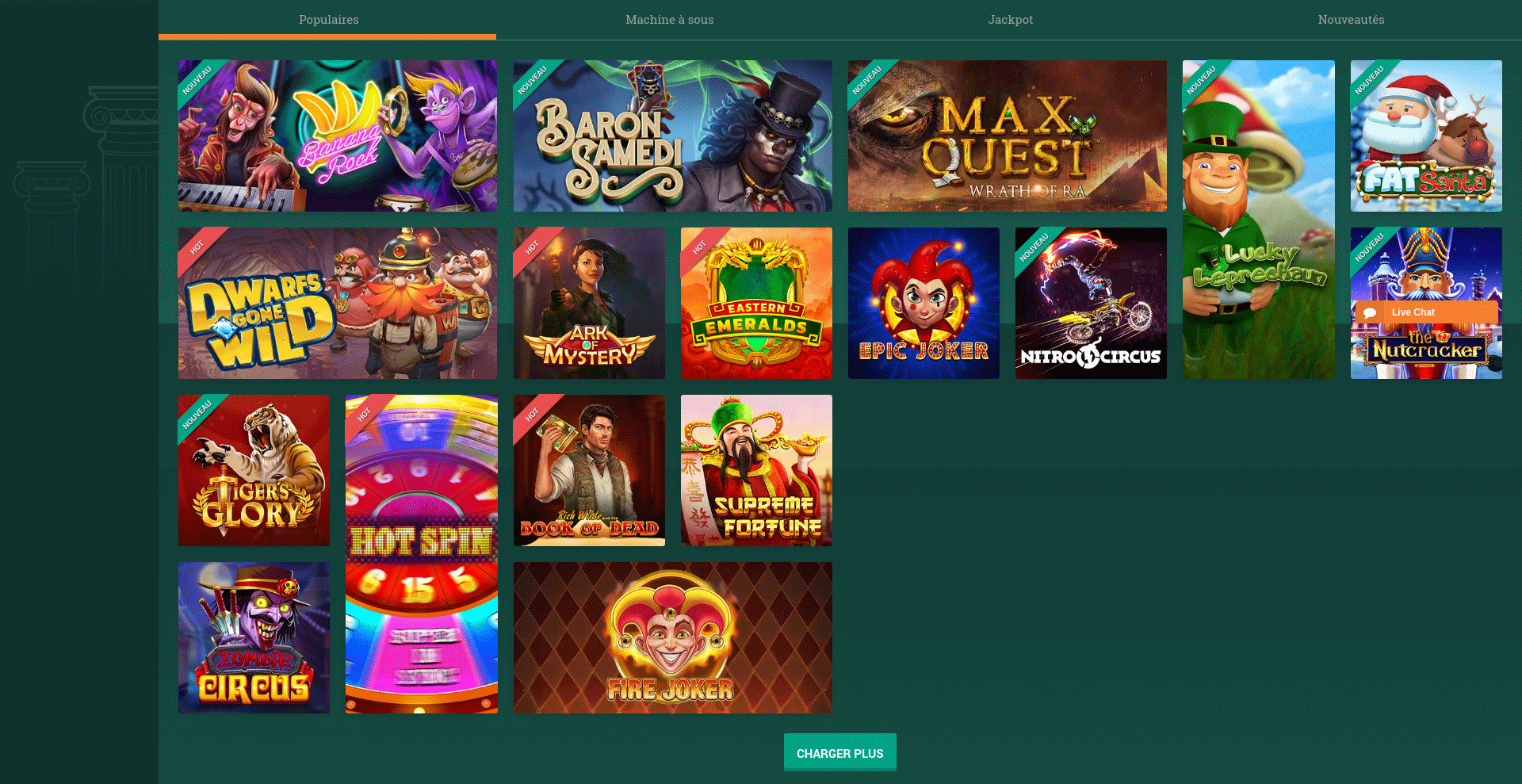

Ma chance : en apprendre plus sur ce célèbre casinotier

Ma Chance figure régulièrement dans le top3 des casinos en ligne qui privilégient de nombreux comparateurs en ligne. La plateforme ne manque en effet pas d’arguments. Le premier est le fait qu’une équipe d’experts dans le domaine se trouve derrière. Cela lui a permis d’avoir un graphisme soigné et une ergonomie ingénieuse.

Cette ergonomie se manifeste notamment par une répartition par catégorie, à travers des onglets, de ses 800 jeux environ. Les connaisseurs savent pertinemment que la plateforme ne cesse d’enrichir son catalogue, grâce à son réseau de fournisseurs renommés. Parmi ceux-ci, citons notamment Betsoft, NetEnt, Booming Games, Rival Gaming et Pragmatic Play. Le site doit à ces derniers l’existence de ses diverses catégories de jeux. Les titres relatifs aux slots sont les plus nombreux. Cependant, les onglets « video poker », « jeux de tables » et « loterie » sont aussi correctement fournis.

Les avis sur ce site disponibles sur Internet ne sont pas les mêmes en ce qui concerne les bonus. Ce n’est pas que ces derniers manquent d’intérêt, mais leurs conditions d’octroi semblent être plus restrictives. Citons notamment la nécessité de miser 30 fois la valeur totale des bonus. Cet avis sur ma chance vous permettra d’en connaître plus sur cette question. Reconnaissons cependant que la plupart des plateformes procèdent de la même façon.

Pour rappel, le pack de bienvenue du casino est composé de 20 tours gratuits et d’un bonus de :

- 100 % jusqu’à 250 euros

- 300 % jusqu’à 60 euros

Avis sur Lord of spins : vaut-il le coup ?

Lord of Spins est également cité souvent parmi les casinos en ligne pour arrondir ses fins de mois. Cela est dû notamment à la polyvalence de sa ludothèque. On trouve en effet dans cette dernière une grande diversité de jeux repartis entre les catégories suivantes :

- Les machines à sous avec des titres comme Dead or Alive, Jack and the Beanstalk, Gonzo’s Quest, Mythic Maiden, Twin Spin et Dracula.

- Les jeux de carte et de tables comme la roulette américaine, la roulette européenne, le Blackjack et les pokers Hold’em, Caribéen, Three

- Les jeux de casino avec croupiers en direct

Parmi les noms des éditeurs partenaires de la plateforme se trouvent les Evolution Gaming, NetEnt, NYX, Play « n GO, BetSoft. Cela suffit pour dire qu’en termes de qualité, elle n’a rien à envier à la concurrence. L’avis sur Lord of Spins suivant met cependant en avant quelques bémols concernant les jeux sur le site. Parmi ceux-ci, il y a notamment la difficulté de gagner, avec les machines à sous.

Cet avis n’est tout de même pas partagé par tous les joueurs. Certains soutiennent ainsi le contraire et vont même jusqu’à avancer que l’avarice n’est pas caractéristique de la plateforme. Cela semble être fondé sachant que le plafonnement du bonus sur le premier dépôt est de 1000 euros. Pour rappel, le pourcentage de ce bonus est de 200 %.

Des casinos performants pour répondre à votre besoin

Vous vous demandez pour quelles raisons rester sur notre site, pour arrondir vos fins de mois ? La première raison est que nous voulons vous guider dans votre choix de casino en ligne. Les plateformes ne cessent en effet d’augmenter en nombre, voulant profiter de l’accroissement de l’engouement pour les jeux en ligne. Pourtant, certaines d’entre elles ne sont pas dignes de confiance, souhaitant à tout prix amasser de profits sans contrepartie. Elles peuvent, par exemple, être injoignables au moment où vous voulez retirer vos gains. Grâce aux avis sur le comparatif de casinos suivants et nos retours d’expérience, vous saurez quelles plateformes sont à éviter.

Il faut noter que pour établir notre comparatif, nous nous sommes basés sur plusieurs aspects déterminant la qualité des casinos. C’est le cas notamment des offres de bienvenue et des promotions. Il y a aussi la réputation des éditeurs de jeux partenaires, sans oublier la qualité et la quantité des jeux. Nous n’omettons pas également de prendre en compte l’efficacité et la disponibilité du service client. Notre évaluation considère aussi, par ailleurs, la diversité des solutions de paiement proposées.

Le Guide Ultime pour Trouver le Meilleur Casino en Ligne en 2024 : Conseils et Astuces

Introduction Bienvenue dans l’univers palpitant des casinos en ligne en 2024, où le choix du meilleur casino devient une aventure en soi ! Nous sommes ici pour vous guider à travers cet univers dynamique et en constante évolution, avec une attention particulière aux besoins des joueurs français. Grâce à cet article, vous découvrirez comment identifier […]

Les bonus du Winoui Casino France

Introduction aux bonus du Winoui Casino Winoui Casino est l’un des meilleurs casinos en ligne en France, offrant une grande variété de bonus pour satisfaire tous les types de joueurs. Que vous soyez un nouveau joueur ou un habitué, vous trouverez un bonus qui correspond à vos besoins. Dans cet article, nous passerons en revue […]

Sûreté et sécurité des casinos Winoui

La sûreté et la sécurité sont deux aspects cruciaux à prendre en compte lorsqu’on joue dans un casino en ligne. Dans cet article, nous allons explorer en détail comment le casino Winoui garantit la sûreté et la sécurité de ses joueurs à travers plusieurs mécanismes et protocoles. Nous aborderons également l’historique du casino, pour comprendre […]

Peut-on payer avec un Neosurf mineur ?

Сasino Neosurf mineur est une solution révolutionnaire dont le but est de faciliter les paiements en ligne. C’est d’abord la France qui a été séduite par sa facilité d’obtention et son utilisation à portée de main. Quelque temps après, son succès le précède et se répand en Suisse puis en Belgique. Plus tard, viendra le […]

Casino en ligne : Découvrez l’expérience de jeu incomparable de Casino770

Si vous êtes un passionné de jeux de casino en ligne, vous savez à quel point il est important de choisir un casino en ligne fiable et de qualité pour profiter pleinement de votre expérience de jeu. Casino770 en ligne est là pour répondre à toutes vos attentes en termes de jeux de casino. Dans […]

Quelles actions américaines acheter ?

Malgré leur grande rentabilité, les actions américaines sont parfois frappées de fortes crises. Dans ce contexte, il devient plutôt compliqué de choisir celle dans laquelle vous devez investir. Si vous hésitez, voici la liste de quelques actions américaines que vous devriez acheter. Achetez l’Action rentable Apple Avec une capitalisation boursière de plus de 2000 milliards […]

Comment créer un site de poker en ligne ?

Le poker est un jeu qui rend très vite accroc son joueur. Pour cela, la plupart des joueurs décident créer leur propre salle de poker en ligne. La création d’un site de poker en ligne est un projet qui demande une bonne réflexion et une bonne préparation. Voici quelques conseils qui vous aideront à créer […]

Avis sur Vive Mon Casino : des opportunités à saisir

Pour gagner de l’argent sur internet, jouer aux jeux d’argent est l’un des moyens les plus populaires en ce moment. Vive Mon Casino s’est lancer sur marché depuis quelques années, malgré son manque d’expériences, il présente des aspects intéressants. Voilà notre test et avis complet sur ce site. Des opportunités de bonus important avec Vive […]

Vegas plus casino avis : de bonnes raisons de le privilégier

Si jouer dans un casino procure du plaisir, un casino en ligne est encore plus intéressant puisqu’il permet de s’amuser et de gagner partout où l’on se trouve. Toutefois, avec le nombre de plateformes qu’on retrouve sur la toile, il faut rester vigilant lorsqu’on fait un choix. Voici pourquoi vegas plus casino représente un bon […]

Avis sur Machance Casino : des chances de décrocher le jackpot

Les parieurs ont tout un jour rêvé de décrocher le Jackpot. Pour cela, le choix du meilleur établissement virtuel est primordial. Machance Casino se présente comme étant un site de référence dans ce domaine. Pour avoir une vision globale du site, nous avons fait un test avec de donner notre avis. Des jeux adaptés à […]

Lucky8 casino avis : une plateforme que nous avons jugée bon de vous présenter

Si les joueurs recherchent un casino en ligne pour s’amuser et empocher le jackpot, certaines plateformes de leur côté recherchent des pigeons à plumer. Il est donc très important de faire des enquêtes avant de décider de s’inscrire sur un casino en ligne. Concernant lucky8 casino, voici tout ce que vous devez savoir. Présentation de […]

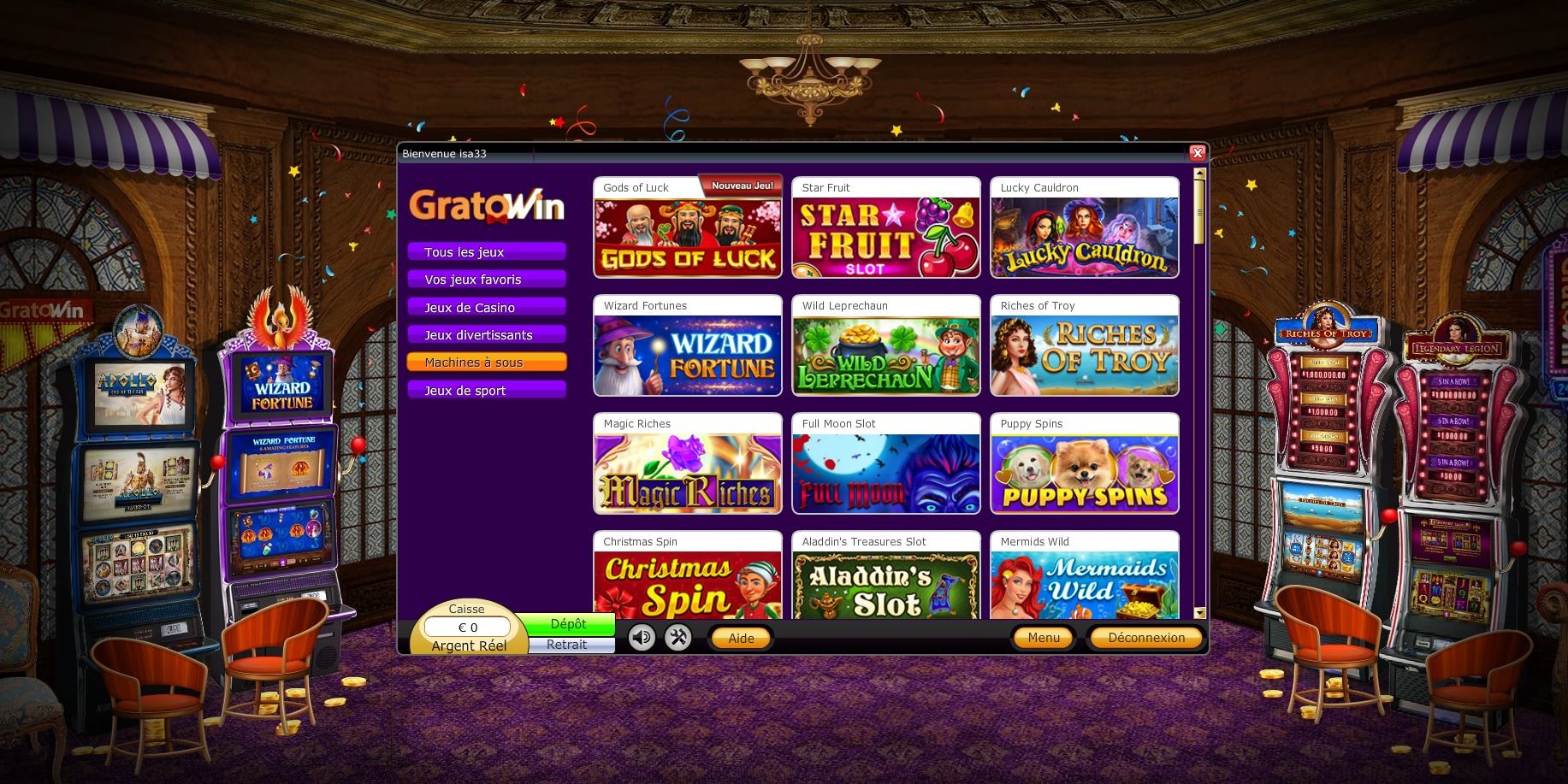

Avis sur Gratowin : pourquoi s’y inscrire ?

Gratowin est un site de jeux virtuels qui n’est connu que par les grands amateurs de jeux de grattage. Il possède une licence qui lui permet d’être fiable aux yeux des joueurs francophones. Mais est-il intéressant de faire une inscription sur Gratowin ? La pratique des bonus exclusifs sur Gratowin Pour motiver plus de joueurs à […]

Avis sur Cresus casino : un site de jeux hors normes

Cresus Casino est un survivant parmi d’autres sites de jeux en ligne issus du même groupe qui ont fermé. La qualité des prestations fournies aux joueurs lui a permis de continuer ses activités. Mais quelles sont les qualités qui ont déterminé la longévité de la plateforme ? Des logiciels de jeux variés et de qualités sur […]

Les brokers

Nous présentons également l’évaluation des sites de trading du commerce afin que vous puissiez jouir de la meilleure expérience possible et saisir toutes les opportunités pour gagner un bon salaire.

Changez votre mode de vie grâce au trading, trouvez nos meilleurs conseils

Trader est actuellement une tendance. Cela reste un bon moyen de gagner de l’argent. Bien évidemment, le trading permet d’améliorer les conditions de vie, à condition qu’il soit bien réalisé. Le trading ne se fait pas n’importe comment. Il doit être fait dans la bonne base. Pour bien trader, voici nos astuces pratiques.

Changez votre mode de vie grâce au trading

Il est tout à fait possible de changer le mode de vie en lançant dans le trading. En effet, ce dernier permet de réaliser un réel gain d’argent. Pourtant, cela ne s’acquiert pas n’importe comment. Il est nécessaire d’opter pour un meilleur broker. Il n’y a pas que cela ! Des critères sont également à tenir en compte. En plus, une liste noire des sites frauduleux est publiée chaque année.

Changez en choisissant les meilleures banques du marché

Pour trader dans de bonnes conditions, il est nécessaire de bien choisir une meilleure banque en ligne. Pour cela, il est nécessaire de bien définir vos besoins. Il est bien évidemment nécessaire d’opter pour une banque offrant des produits répondant aux besoins. Il est toujours nécessaire d’opter pour une banque très intéressante. Pour éviter les mauvaises surprises, il est nécessaire de bien vérifier les propositions de la banque.

Pour faciliter votre recherche, découvrez cette sélection des meilleures banques en ligne. Le classement de ses banques repose sur de nombreux paramètres. Il est à savoir que nombreuses sont les banques qui proposent de tarifs qui sont bien abordables. Notez qu’une banque en ligne propose une tarification plus intéressante qu’une banque ordinaire. La plupart des banques citées dans cette sélection proposent de meilleurs services. Notez la présence d’une assistance client qui est entièrement professionnelle.

Aussi, pour le choix d’une banque en ligne, il est d’une grande importance d’assurer la sécurité que celle-ci offre. En effet, avec le piratage en masse des banques, il est toujours important de rester vigilant. Bien évidemment, lorsqu’il y a question d’argent, les arnaqueurs ne sont pas loin. Bien évidemment, pour assurer les données personnelles des utilisateurs, les bonnes banques en ligne optent pour de la haute technologie. Certes, le choix d’une plateforme trading ne doit pas être pris à la légère.

Optez pour un broker de qualité

Un broker de qualité se juge par sa régulation. En effet, un courtier digne de confiance doit être entièrement en règle. Bien évidemment, une bonne régulation reste un gage de fiabilité du courtier. Avant de se lancer dans n’importe quel broker, il est important de s’assurer qu’il est utilisable dans votre pays. Cela vous aidera à vous lancer facilement dans le monde du trading. Trouvez ces meilleurs brokers. Il est à noter que ceux-ci se jugent selon plusieurs critères.

Pour le choix d’un courtier en ligne, il est nécessaire toujours tenir compte de l’effet de levier. En effet, ce dernier est parfaitement en mesure de modifier les gains ou pertes que peut acquérir un investisseur. Il est également nécessaire de prendre en compte l’apprentissage que peut offrir le broker. Bien évidemment, un bon broker digne de ce nom propose de nombreuses formations. Celles-ci ont été créées dans le but d’aider les traders à évoluer dans le domaine.

Parmi les meilleurs brokers forex, on peut trouver IG markets. Il est particulièrement apprécié par les promesses qu’il peut offrir. Aussi, il promet aux traders d’investir très facilement. Ce qui est appréciable avec ce courtier en ligne, c’est qu’il met en place un compte démo.

Vantage FX saura peut-être vous convaincre

Vantage FX fait partie d’un des meilleurs courtiers. Il s’agit d’une plateforme de trading d’origine australienne qui a été créée en 2009. Ce broker forex peut parfaitement exercer sur toute la France. Il permet de trader des actifs boursiers. Avec ce courtier en ligne, 38 paires de devises sont tradables. Cela rend le site très intéressant. Avec ce courtier en ligne, de nombreuses matières premières peuvent également être tradées.

Ce qui est intéressant avec ce Vantage FX, c’est qu’il existe en version mobile. Celle-ci est parfaitement adaptée aux petits écrans. Que votre mobile dispose d’un système d’exploitation iOS ou Android, la version peut y être installée. Aussi, les transactions sur le site sont entièrement souples. Plusieurs moyens de paiement sont à disposition. Pour d’amples informations, découvrez cet avis sur vantage fx.

Outre cela, ce broker forex est aussi apprécié par la présence de son compte démo. En effet, cela vous permet de tester la plateforme sans avoir à vous inscrire. Un service client disponible 7 j/7 et 24 h/24 est aussi à votre disposition pour vous apporter l’aide nécessaire. Pour aider les traders débutants, ce courtier en ligne met en place de nombreuses formations.